Are deathbed items ever a superb monetary choice?

“While there are always exceptions, the truth is that in the vast majority of cases it is a bad idea to transfer assets out of a person’s name just before death”, says Jamie Hargrove, an lawyer, CPA, and property planning skilled.

Hargrove says, “Consequently, even though an estate is ‘taxable’, there really are no taxes due. There are a few states that still have an inheritance tax and, of course, in very large estates you may be subject to federal estate tax. Those situations, however, are the exception, not the rule, and even in those situations, the laws are drafted in such a way as to eliminate any benefits from last-minute deathbed planning options.”

Related: Why NOT to Use Deathbed Gifts: Understanding Your Options When Estate Planning

Hargrove sat down with Retirement Daily’s Robert Powell to clarify why deathbed items are normally a nasty thought. Hargrove offered different property planning methods together with step-up foundation guidelines, taxable estates, probate, the advantages of retaining your property, and what to do if you happen to already transferred them over.

Read the complete Q&A under or watch the video above.

Deathbed Tax Planning Basics

Robert Powell Asks: Jamie, why are deathbed items such a nasty thought?

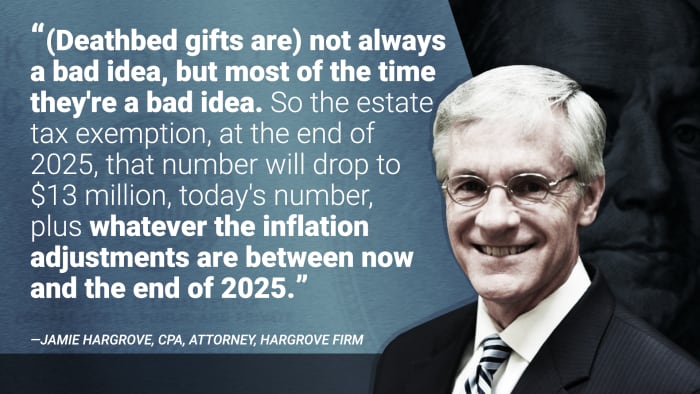

Jamie Hargrove: Well, they are not at all times a nasty thought, however more often than not they seem to be a unhealthy thought. So the property tax exemption, on the finish of 2025, that quantity will drop to $13 million, at the moment’s quantity, plus regardless of the inflation changes are between now and the tip of 2025.

That assumes that Congress and the president do not get collectively and do one thing to maintain that from simply that regulation sunsetting. So until all people will get collectively and says, we wish to preserve it and the assumption is that will not occur, you then’re a couple of $13 million property tax exemption. But nonetheless even at $13 million, most of us need not fear concerning the property taxes. So the concept I have to eliminate one thing simply earlier than I die to save lots of property taxes isn’t a good suggestion. Even within the property tax world, it does not aid you anyway.

Deathbed and Probate Explained

So why do you wish to cling on to property? Because some would possibly say, nicely, not less than if I eliminate it, I can keep away from probate. Well, there are higher methods to keep away from probate. So let me provide you with an instance of why it is a unhealthy thought. So to illustrate that I’ve bought a household farm, the household farm’s value a few $100,000. Right, however I inherited the farm a few years in the past, 30 years in the past, when it was value hardly something. Nothing hardly bought allotted to the land itself. Everything was to the buildings and the barns. They’ve been depreciated. So I successfully have a zero foundation.

Now if I give that $200,000 to my, to illustrate I’ve bought two youngsters, and I give it to my two youngsters on my deathbed simply two days earlier than I die. And then they promote the property weeks later, months later, years later, every time they promote it, and to illustrate they promote it for $200,000. Then in that scenario, they are going to pay capital positive aspects on a $200,000 acquire. So even when they’re in a state that pays no state earnings taxes, they’re 20% capital positive aspects. They’re going to pay $40,000 in capital positive aspects taxes.

TurboTax Live consultants look out for you. Expert assist your means: get assist as you go, or hand your taxes off. You can speak dwell to tax consultants on-line for limitless solutions and recommendation OR, have a devoted tax skilled do your taxes for you, so that you will be assured in your tax return. Enjoy as much as an extra $20 off while you get began with TurboTax Live.

Taxable Estates Explained

Now, the identical state of affairs. I’m on my deathbed. I’ve bought a $200,000 farm. I’ve bought two youngsters, I’ve bought a deed right here that I can signal and simply give to the youngsters earlier than I die. But I do not get round to doing it. Thank goodness I did not get round to doing it as a result of now the farm continues to be in my title after I die. Because it is in my title, it is truly taxed in my taxable property. But that is OK as a result of I’ve this large exemption towards property taxes. Most states haven’t got an inheritance tax, hardly any at this degree. And so there actually are not any unfavourable penalties to having that farm in my property. The excellent news is as a result of it is in my taxable property, although I do not pay taxes, I get a step up in earnings tax foundation.

What does that imply? That signifies that the zero tax foundation on that farm now adjusts to 200,000. So now my two youngsters inherit a farm that has a tax foundation of $200,000. They now promote it shortly after I die or two years after I died. It does not matter after they promote it, however assuming they promote it for $200,000, they pay zero taxes. And they simply saved $40,000 in capital positive aspects tax.

Accidentally Transferred Assets, Now What?

Robert Powell: So what if somebody made an oops and the property had been already transferred? What then?

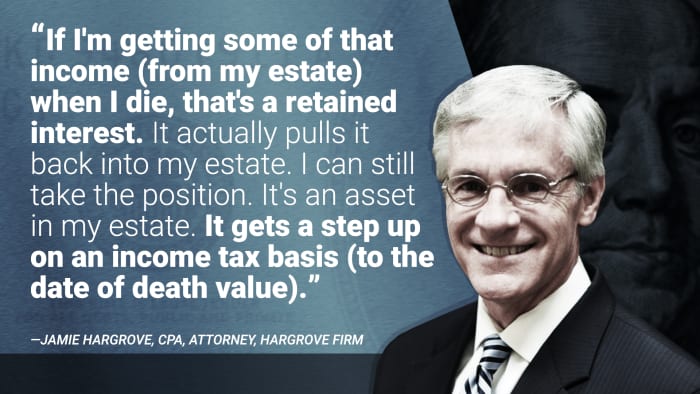

Jamie Hargrove: Good query. So many occasions, to illustrate I’m residing on my farm. I’ve bought a bit of home on that little farm, nevertheless it’s rural, within the rural space. But I bought a home on it and I give that away. Well, it seems like unhealthy information, however the reality is, I’m nonetheless residing on the property. So what you are able to do is you might simply ask some questions if you happen to’re the accountant or the advisor monetary planner. Find out if there may be any retained curiosity. So perhaps I did not dwell on the property as a result of if you happen to make a present and also you proceed to retain an curiosity in that property, that retained curiosity truly pulls it again into your property.

Now, years in the past, when the property tax exemption was $600,000, that was unhealthy information. Today, it is truly excellent news. We truly search for these retained pursuits. So perhaps I haven’t got a home on the farm, however I nonetheless have some hay or some cattle. And I’m truly getting the earnings from a few of these crops or a few of that exercise. If I’m getting a few of that earnings after I die, that is a retained curiosity. It truly pulls it again into my property. I can nonetheless take the place. It’s an asset in my property. It will get a step up on an earnings tax foundation (to the date of dying worth).

Robert Powell: All proper, Jamie, I wish to thanks for sharing your data and knowledge with our readers and viewers. It’s vastly appreciated.

Jamie Hargrove: Appreciate the chance. Great to catch up.

Editor’s Note: The content material was reviewed for tax accuracy by a TurboTax CPA skilled.

Source: www.thestreet.com