Real Estate Investment Trusts, or REITs, provide a way for individuals to invest in large-scale, income-producing real estate without the need to directly purchase or manage properties. By pooling investor capital, REITs own, operate, or finance various real estate properties, offering potential for steady returns.

A REIT is a company that owns, operates, or finances income-generating real estate in sectors like retail, residential, industrial, healthcare, and office spaces. Most REITs trade on major stock exchanges, making them accessible to individual investors who can buy shares similarly to stocks. By law, REITs must pay at least 90% of their taxable income as dividends to shareholders, offering investors regular income.

There are several types of REITs, each serving different investment needs and focusing on various real estate sectors:

Equity REITs: These REITs own and operate income-producing properties, generating revenue primarily through leasing.

Mortgage REITs (mREITs): mREITs provide financing for income-producing real estate by purchasing mortgages and mortgage-backed securities, earning income from interest on these financial products.

Hybrid REITs: These REITs combine equity and mortgage investments, offering a mix of income from property ownership and mortgage financing.

Publicly Traded REITs: These REITs are listed on major stock exchanges and are accessible to individual investors who can buy and sell shares like stocks.

Public Non-Traded REITs: While registered with the SEC, these REITs don’t trade on exchanges, offering potentially lower volatility but limited liquidity.

REITs offer several advantages to investors, especially those looking to diversify their portfolios and gain exposure to real estate without the complexity of direct property ownership:

Income Potential: With their requirement to distribute 90% of income as dividends, REITs provide investors with regular income, which can be attractive in low-interest environments.

Diversification: Adding REITs to a portfolio provides exposure to real estate, which typically has a low correlation with stocks and bonds, reducing overall portfolio risk.

Accessibility: Since many REITs are publicly traded, they offer an easy entry point into real estate investing for individuals with limited capital.

Professional Management: REITs are managed by professionals, meaning investors benefit from expert management of real estate assets without the need for hands-on involvement.

While REITs have many benefits, they also come with risks that investors should consider:

Interest Rate Sensitivity: REITs often react to changes in interest rates. As rates rise, borrowing costs increase, which can affect profitability and lead to lower share prices.

Market Risk: Publicly traded REITs are subject to stock market fluctuations, which can lead to volatility similar to other equities.

Sector-Specific Risk: REITs focused on specific sectors, like retail or hospitality, may be more vulnerable to economic changes affecting those industries.

Liquidity Risks: Non-traded REITs have limited liquidity, which means investors might face challenges in selling their shares.

Investing in REITs is straightforward, with options that suit various investment preferences:

Direct Purchase: Investors can buy shares of publicly traded REITs through a brokerage account.

REIT Mutual Funds and ETFs: These funds allow investors to buy shares in multiple REITs at once, providing broad exposure to the real estate sector and reducing individual REIT risk.

Private REITs: These REITs are not available on public exchanges and are typically open only to accredited investors, offering potential high returns but with more risk and less liquidity.

REITs offer a unique way to invest in real estate, providing potential income and diversification benefits without the need for property ownership. While they come with their own set of risks, REITs remain a popular choice for individuals looking to gain exposure to real estate. Understanding the different types of REITs and aligning them with your investment goals can help you make informed decisions in building a diversified portfolio.

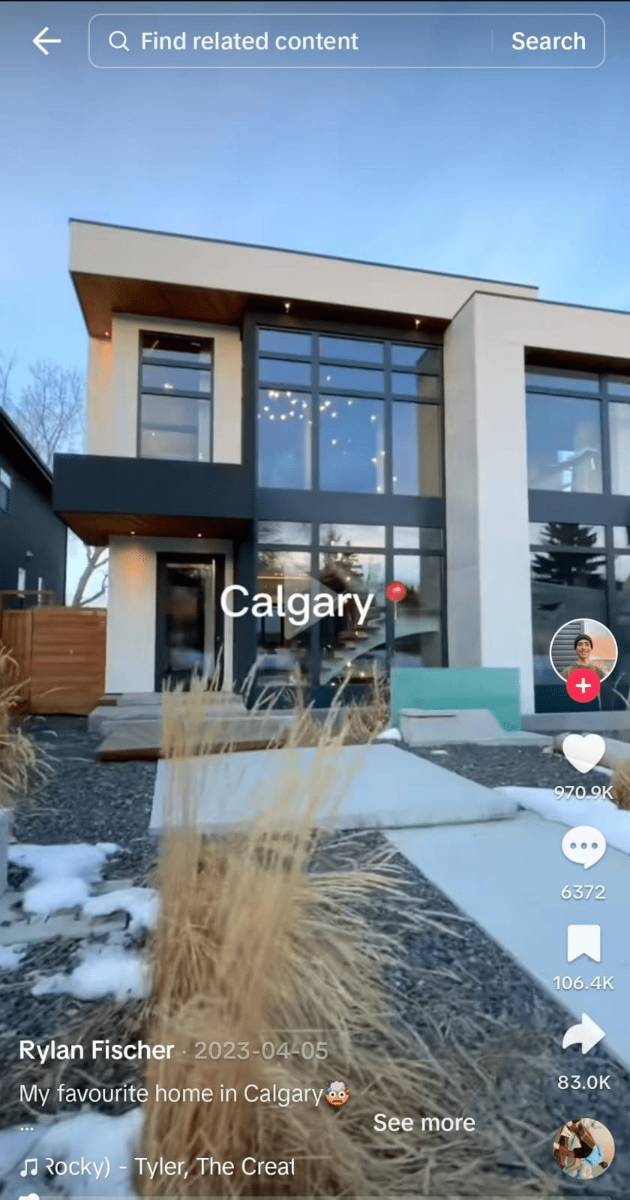

Top 7 Real Estate Social Networks You Need in 2024

Gender-neutral fashion has been gaining significant traction in recent years, challenging traditional gender norms and embracing individuality. Designers, brands, and consumers are pushing the boundaries of what it means to dress in a way that transcends the male-female divide. This rise in gender-fluid clothing represents a cultural shift toward inclusivity, freedom, and expression.

For travelers who seek unparalleled luxury, certain experiences are worth the investment. From lavish resorts to private island retreats, here are some of the most indulgent travel experiences worth the splurge.

One Hyde Park

Achieving a timeless, elegant look is a goal many fashion enthusiasts strive for. However, certain mistakes can detract from that classic style, making an outfit look dated or overly trendy. To help you build a wardrobe that transcends trends and remains stylish for years to come, here are some common fashion mistakes to avoid.

As we enter 2024, the fashion world is buzzing with new trends that push boundaries and celebrate individuality. From innovative materials to nostalgic revivals, this year's fashion landscape is all about embracing the unexpected and finding personal style in fresh ways. Here are some of the top fashion trends to watch for in 2024.